retroactive capital gains tax hike

This percentage was bumped up to 75 in 2009 and then 100 in 2010. If you add state taxes like Californias current 133 rate the government gets most of your gain.

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

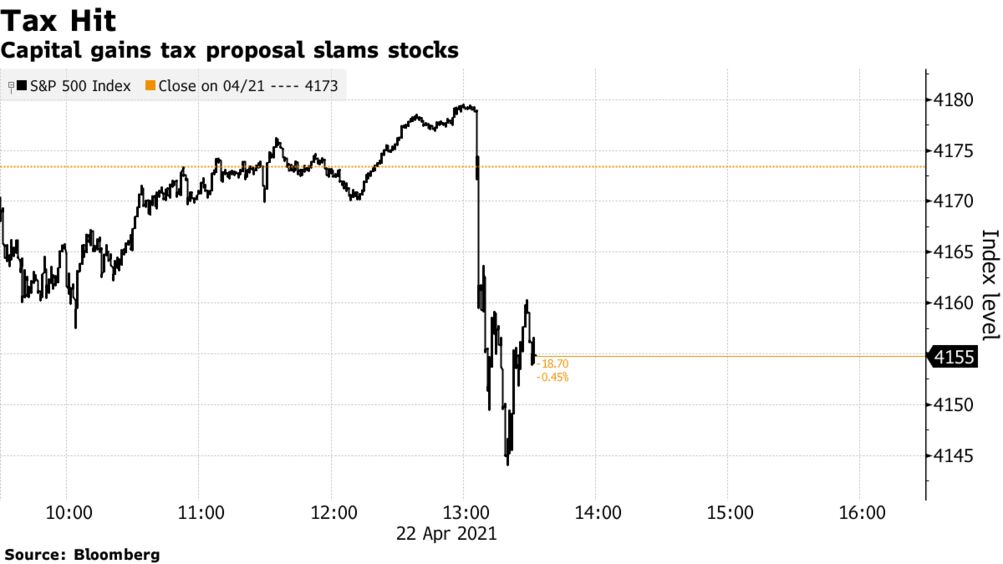

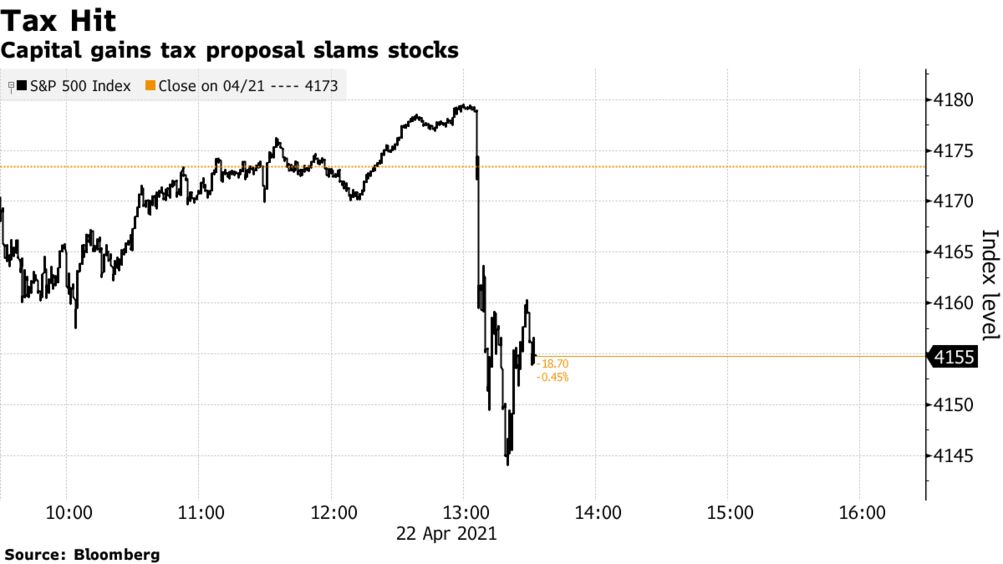

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

. Put another way if Democrats enact a tax increase in the second half of 2021 how likely is it that the effective date of the tax increase will be January 1 2021. I can shed some light on one of the most significant issues for many. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

Critics of the plan say it will hurt investment and economic growth by penalizing gains. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a.

A natural reaction to a looming tax hike is to sell quickly before the new law takes effect. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. The Democrats proposed tax deduction for the rich puts the Vermont socialist and low.

Before the 1913 Revenue Act became effective. The purpose of the tax exemption is to promote investment in small innovative businesses that are scalable and would ultimately create more American jobs. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9president bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales. Advisors look for ways to lessen Bidens proposed retroactive capital gains tax hike President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous. Signed 5 August 1997.

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. But many were taken off guard by the May 2021 announcement that the increase would be implemented retroactively with a potential start date as early as April 2021. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income.

Id say 50-50 on corporate taxes being retroactive and 25 percent capital gains taxes are retroactive Lucier is slightly more optimistic. A tax increase has been retroactive to a certain date. Are retroactive tax increases constitutional or even fair.

Capital gains on investments can result in triple-taxation. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. Reduced the maximum capital gains rate from 28 percent to 20 percent.

The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated rate. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Since 1993 investors in Qualified Small Businesses have been able to exclude 50 of their capital gain from federal taxes.

During the years up to 1962 it was possible for the tax department to impose retrospective capital gains tax on deals involving the exchange of shares among foreign entities located in India thanks to an amendment to the Finance Act. The effective date of any increase in the long-term capital gains tax rate. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

He gives 20-percent odds on the new taxes being imposed. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you could be impacted.

The capital gains tax hike would be retroactive to the date of announcement making it.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Managing Tax Rate Uncertainty Russell Investments

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden S Capital Gains Tax Hike Will Be Retroactive To The Date Of Announcement Invezz

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

What Can The Wealthy Do About Biden S Proposed Tax Increases

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Biden S Proposed Retroactive Capital Gains Tax Increase

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Advisers Blast Biden S Retroactive Capital Gains Proposal

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg